If you're not saving enough and I tell you to start saving today, you're not going to do it. Instead, if I tell you not to save more today, but to start saving more only when you get your pay raise in the future, you'll probably take my advise.

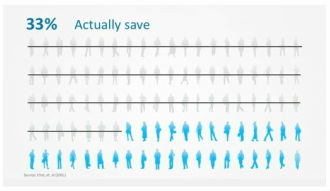

Only a third of people actually formally save money, like having a 401(k) account or something. For many people, save more today is just not an option. I can understand that and you can too, if you know a bit of behavioral finance.

Behavioral finance is a combination of psychology and economics. Understand behavior finance helps you know money mistakes that people make, so that you can turn money challenges into solutions. My understanding of behavioral finance is that to start saving, people are likely to face 2 major obstacles - lack of self-control and inertia - because save now is so painful and it's natural to have loss aversion. The solution must overcome these two major obstacles, and the solution must be easy enough to carry out with the least effort.

What can you do to start saving in the near future? Next time you get a pay raise you've got to set aside your pay increase as your saving so you won't have too much of loss aversion. Hopefully, you won't feel as bad as a money which feels bad when someone takes an apple away from it when it has two apples. Review the percentage of your 401(k) contribution as a percentage of your salary and stick with it or raise a percentage or two will help in the long run. If you're still young and can afford a higher percentage, then maximize it. For the rest of you to whom 401(k) doesn't apply, know the concept of behavioral finance on steroids may only be a plus. For that, watch this TED session presented by Shlomo Benartzi who studies behavioral finance with a special interest in personal finance.

---

by Charles Gwa

Behavioral finance is a combination of psychology and economics. Understand behavior finance helps you know money mistakes that people make, so that you can turn money challenges into solutions. My understanding of behavioral finance is that to start saving, people are likely to face 2 major obstacles - lack of self-control and inertia - because save now is so painful and it's natural to have loss aversion. The solution must overcome these two major obstacles, and the solution must be easy enough to carry out with the least effort.

What can you do to start saving in the near future? Next time you get a pay raise you've got to set aside your pay increase as your saving so you won't have too much of loss aversion. Hopefully, you won't feel as bad as a money which feels bad when someone takes an apple away from it when it has two apples. Review the percentage of your 401(k) contribution as a percentage of your salary and stick with it or raise a percentage or two will help in the long run. If you're still young and can afford a higher percentage, then maximize it. For the rest of you to whom 401(k) doesn't apply, know the concept of behavioral finance on steroids may only be a plus. For that, watch this TED session presented by Shlomo Benartzi who studies behavioral finance with a special interest in personal finance.

---

by Charles Gwa

RSS Feed

RSS Feed